According to the U.S. Energy Information Administration, 20 million barrels of oil flow through the narrow Strait of Hormuz daily.

The 33-kilometer gap feeds one-fifth of the world’s supply. Global gas prices can jump with the slightest escalation or rise in tensions. Recent conflicts have made this waterway more dangerous than ever.

Rising Costs

According to Reuters, war risk insurance premiums for vessels transiting the Persian Gulf jumped to 0.5% from around 0.2-0.3% a week earlier.

This small percentage can add tens of thousands of dollars per voyage for an oil tanker worth $100 million. The costs are often passed on to consumers at gas pumps worldwide.

Old Enemies

Iranian and American ships have been butting heads in the region for decades. After recent airstrikes on Iranian nuclear sites, tensions reached new heights, according to multiple sources.

Both sides followed tensions and escalations with increased presence and started jamming GPS signals. This resulted in ships getting lost and appearing on navigation screens in impossible locations.

Electronic War

By July, fewer ships dared to cross the strait as GPS jamming intensified. Commercial vessels reported waiting hours for clear navigation signals.

Iran officially denied interfering, but insurance companies responded by raising war-risk premiums according to Safety4Sea. The invisible electronic battlefield was making shipping increasingly treacherous for commercial vessels.

Close Encounter

On July 23rd at 10:50 AM, an Iranian SH-3 Sea King helicopter flew just meters above the American destroyer USS Fitzgerald, according to Navy Times.

Iranian media reported the pilot ordered: “Change your course!” Iran says the ship retreated, while America says it continued normally. Either way, this confrontation made global headlines.

Market Panic

Oil prices climbed after footage of the helicopter encounter spread on social media. According to industry reports, major shipping companies kept their schedules but raised prices again.

Every close call between military forces affects global energy markets. Traders watch these waters constantly, ready to react instantly.

He Said, She Said

“This interaction had no impact on USS Fitzgerald’s mission and any reports claiming otherwise are falsehoods,” a U.S. defense official told Fox News Digital.

Iran gave a different view of events, celebrating forcing the destroyer to back down, according to Iranian state television. Two completely different stories from the same incident reflect competing narratives.

Legal Gray Zone

Iran claims the right to control its coastal waters under international law. America insists on free passage for all ships according to maritime conventions.

International law remains murky, and neither side seems ready to back down. Until lawyers resolve the issue, sailors and pilots will keep testing boundaries.

Price Swings

Every headline in the Gulf impacts oil markets, as computer algorithms buy and sell based on conflict keywords in news stories.

A single tweet about military movements can move prices significantly. According to experts, volatility drives today’s energy market fluctuations, not actual supply shortages.

Hidden Costs

According to Reuters, war-risk insurance has jumped significantly since June, adding substantial costs to large tanker voyages.

These hidden costs hit consumers at gas stations worldwide without significant incidents. Insurance mathematics, not missiles, may be 2025’s stealthiest driver of inflation for ordinary families. Further than driving up the price of oil, escalations in the region affect real people on oil tankers trying to stay on schedule.

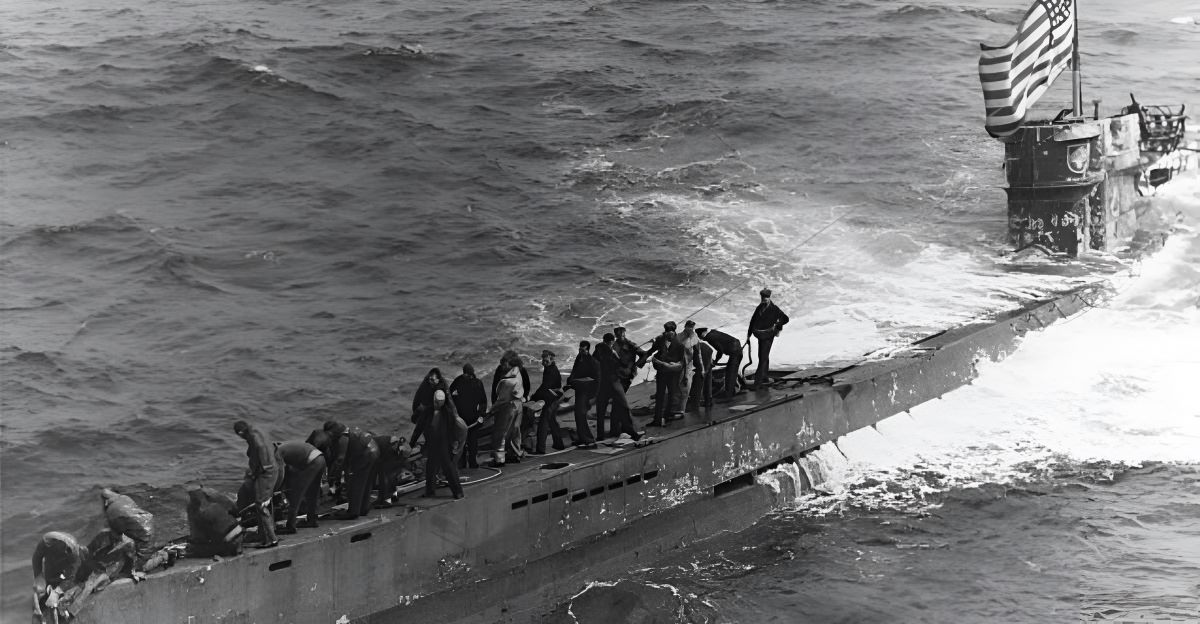

Lost at Sea

Greek captain Konstantinos Tsotras was navigating his oil supertanker through the Persian Gulf when it “disappeared from his navigation screen,” according to Bloomberg.

His electronic navigation systems had been interfered with during the Iran-Israel conflict. His cargo, worth $260 million, sat in dangerous waters.

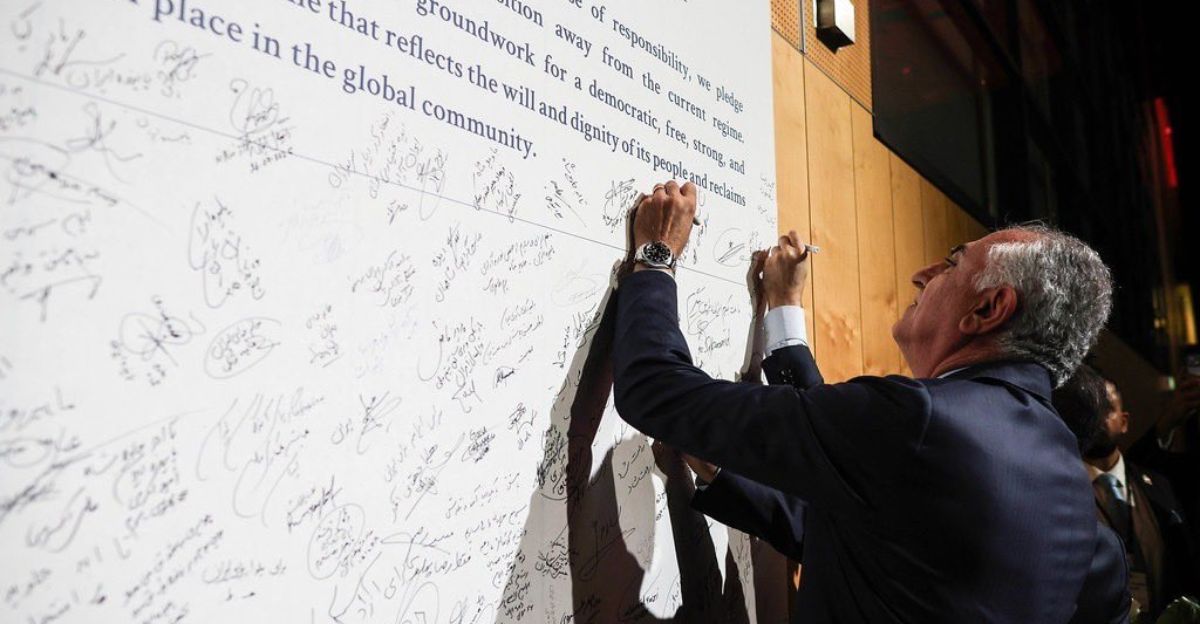

New Leaders

Iran has recently changed some of its naval command after Israeli strikes killed several commanders, according to regional reports.

Iranian military sources reported that the new admirals promise a more assertive defense of Gulf waters. Leadership changes often signal policy shifts. Shipping companies now track Iranian personnel movements as closely as ship movements.

Backup Plans

Emergency procedures in major shipping lanes have been updated: keep radios on, engines ready, prepare to stop immediately if warned by warships, according to industry guidance.

If freight ships must reroute their voyage around Africa, it adds two weeks to the voyage and costs millions. The passage through Hormuz remains the best option, but it is becoming increasingly expensive.

Worst Case

Experts at the Center for Strategic and International Studies warn that Iran’s closure of the strait could disrupt 15 million barrels daily.

CSIS analysts say the probability remains low but rises with each confrontation. Both Iran and America profit from keeping oil flowing, but accidents happen between heavily armed forces.

Ticking Clock

The helicopter flew away without firing, according to Al Jazeera. Oil still flows.

However, maritime experts say that each close call erodes the margin for error in the world’s most important waterway.