President Trump’s sweeping trade offensive just claimed a new victim: India. On July 30, the White House announced 25% tariffs on all Indian imports starting Aug 1, plus an extra penalty for any deals involving Russian oil or arms.

Nearly $87.4 billion of Indian goods flow into the US each year, so this move looms large on both economies.

But beyond the headline numbers, behind-the-scenes revelations threaten to blow up decades of careful diplomacy between the world’s two largest democracies.

Pipeline Pressure

Meanwhile, India’s energy lifeline runs straight through Moscow. Roughly 35–40% of India’s crude oil imports now come from Russia – about 2.08 million barrels per day as of mid‑2025.

India quietly became Putin’s second‑largest oil customer during the Ukraine war, helping bankroll the Kremlin as Western buyers fled.

Trump blasted India’s policy on social media: “They are Russia’s largest buyer of energy, along with China, at a time when everyone wants Russia to stop the killing in Ukraine.” A dependence that once seemed economically savvy now looks politically toxic.

Dual‑Use Dilemma

On paper, India maintained a strict export-control regime. Every dual‑use material sale went through legal review and multilateral non‑proliferation checks – a “robust legal and regulatory framework”, in India’s words.

Yet customs records have since exposed a worrying pattern: supposedly innocent chemicals being routed to Russia’s defense contractors.

For example, officials say an export to the Samara region went to Promsintez, a firm Ukraine’s military flags as linked to the Russian army.

These case-by-case breaches raise hard questions about whether India’s checks are working as intended.

Shadow Deals

Much of this trade occurs in murky private corridors. Small Indian firms selling industrial commodities have inadvertently crossed geopolitical lines. Ideal Detonators Private Ltd of Telangana – a little-known explosives maker – exported $1.4 million of HMX (octogen) to Russia last December, insisting it was for mining and not military use.

Such deals illustrate the gray zone between civilian industry and sanctioned arms suppliers.

Across India, dozens of similar exporters say they follow compliance rules, but pursuing profitable contracts with secretive buyers inevitably tests the limits of acceptable trade.

Chemical Revelation

Then came a startling chemical revelation. In December 2024, customs officials in St. Petersburg flagged two shipments of HMX – a potent military-grade explosive – sent from Hyderabad to Russia.

Valued at roughly $1.4 million, this was the first public confirmation of such a sale since the Ukraine war began. U.S. analysts classify HMX as “critical for Russia’s war effort,” noting it powers missile and torpedo warheads.

One consignment (over $1 million) went to Promsintez in Samara, the other (~$405k) to High Technology Initiation Systems (a Maxam subsidiary).

Ukrainian advisers warn that even if India doesn’t seek to help Russia’s military, “isolated cases can occur,” meaning one small shipment can have outsized impact.

Battlefield Consequences

Indian-made explosives didn’t stay bottled up. By April 2025, Ukrainian drones had followed the trail to Samara. On April 5, SSU commandos attacked the Promsintez factory in Chapayevsk, one of Russia’s largest military explosives plants.

Videos show 20+ massive blasts and fireballs rocking the facility, forcing all production to halt.

Local reports say a tank of nitric acid leaked over a ton of corrosive liquid into the environment.

In a grim calculation, every kilo of HMX shipped from Hyderabad could end up in the warheads raining on Kyiv or Kharkiv.

For Ukrainians under bombardment, that chemical connection is personal: each explosive molecule is a potential missile aimed at their homes.

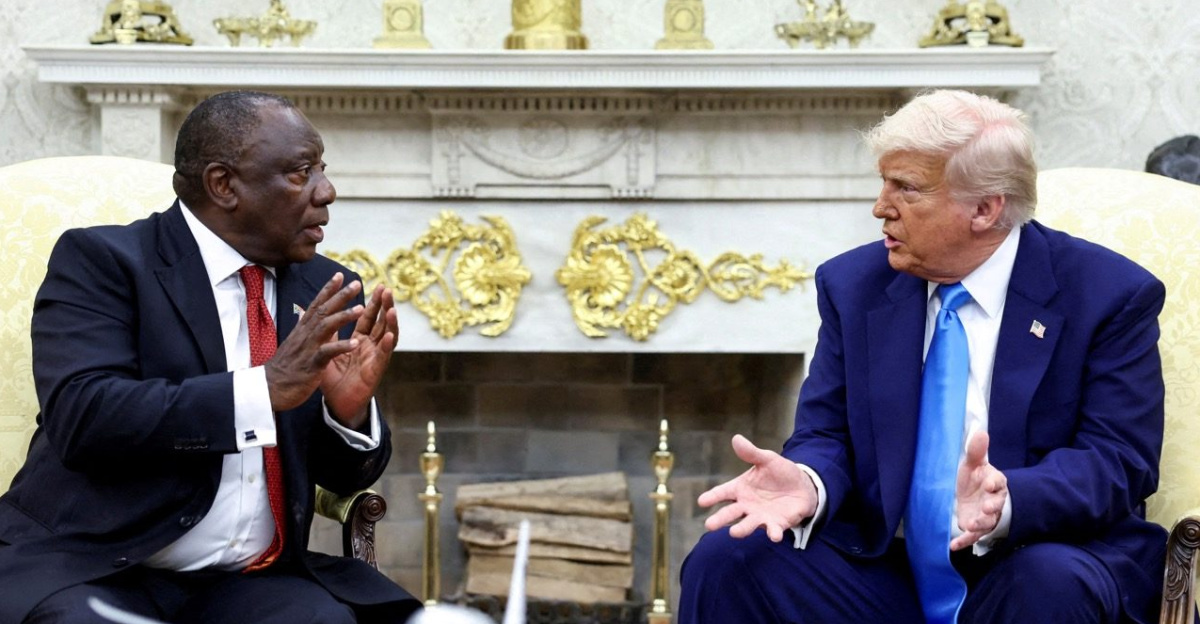

Diplomatic Fallout

In Washington, patience has snapped. The U.S. State Department bluntly warned that “any foreign company or financial institution that does business with Russia’s military-industrial base are at risk of U.S. sanctions”.

India’s government suddenly finds itself in a vice. On one side sits Moscow, with lucrative energy and arms ties.

On the other hand is Washington, a strategic partner demanding alignment. New Delhi’s answer so far: “We adhere to all international commitments” under a rigorous review system.

But as rockets fall on Ukrainian cities, that claim rings increasingly hollow to many allies. U.S. officials stress a showdown: India can’t fully have it both ways.

Market Meltdown

Financial markets are scrambling. On July 18, the EU’s 18th sanctions package came down: it bans refined products made from Russian crude by third countries, directly snuffing out about $14.3 billion of India’s fuel exports to Europe.

India’s refiners, who had profited by processing cheap Russian oil, are now locked out of key customers. Almost overnight, major state refiners including IOC, HPCL, BPCL and MRPL paused Russian purchases.

Private giants like Reliance and Nayara Energy (still tied to Rosneft) continue under legacy contracts, but their exposure to Western sanctions has soared.

The industry is in crisis mode, scrambling to redeploy ships, adjust supply chains and brace for fuel shortages.

Numbers Game

The raw data tell a stark story. India–Russia trade exploded to $68.7 billion in 2024–25 – six times the pre-pandemic level – driven overwhelmingly by fuel and raw materials.

The balance is wildly skewed: India exported just $4.88 billion to Russia, while importing $63.84 billion.

In other words, New Delhi buys roughly 35% of its oil from Moscow, but sends comparatively little back.

Meanwhile, U.S.–India commerce is also large and lopsided: nearly $129.2 billion in 2024, with a $45.7 billion deficit favoring India. Both sides have huge stakes at play – mathematically, a full-scale trade war could seriously damage each other.

Crossroads Ahead

Here’s where it gets personal. India now faces a historic choice. Accept Trump’s ultimatum – stop buying Russian oil – or bear crushing new tariffs. On one side loom cheap fuel bills and Russian goodwill; on the other, access to the vast U.S. market and Western security ties.

Indian Petroleum Minister Hardeep Puri put it bluntly: “India will buy oil from wherever needed, in the interest of the Indian consumer.” But NATO’s chair Mark Rutte warned of consequences if New Delhi hesitates: he told Congress any nation that helped Moscow “would feel it back…in a massive way”r.

Beijing, Brazil and others are watching – China publicly defied U.S. demands to stop buying Russian oil. Whatever New Delhi does, the fallout will be seismic.

The question now isn’t if this crisis reshapes South Asian geopolitics, but how dramatically – and whether global stability will survive the upheaval.

Domestic Uproar

In New Delhi, politicians and businesses are scrambling. The opposition lambasted the tariffs as a self-inflicted wound. Gem and jewelry exporters are especially outraged: Kirit Bhansali, head of India’s Gem & Jewellery Export Council, warned, “the U.S. is our single largest market…a blanket tariff of this magnitude will place immense pressure on every part of the value chain”.

Global credit ratings firms warn the tariffs could shave 0.2–0.3 percentage points off India’s GDP growth. To steady nerves, Prime Minister Modi has played the nationalist card: he urged Indians to “buy locally made goods” to cushion the economy.

At the same time, New Delhi quietly briefed diplomats that it will seek carve-outs, or find new buyers for its goods and energy if the U.S. embargo bites.

Friends, Foes and Finance

The world is watching. Russia’s friends feel the heat: China and Brazil have bristled at U.S. pressure. Beijing dismissed any ultimatum on oil, while Tokyo and Brussels urged calm diplomacy. Financial markets are jittery: global crude prices could spike if India (the world’s third-largest oil importer) is forced off Russian oil.

Treasury analysts estimate forcing the shift could add $9–11 billion to India’s annual import bill. Meanwhile, currency markets swooned; the rupee slid to multi‑year lows in the days after Trump’s announcement, reflecting broad emerging‑market fear.

In this new Cold War–style standoff, the economic shockwaves are already rippling through Asia and beyond.

Markets on Edge

Back home, Indian markets have taken a hit. On news of Trump’s tariff, the rupee fell past ₹87 to the dollar – its weakest in years.

Stock indices wavered as importers rushed to hedge dollar bills. Bond yields ticked up amid flight-to-safety flows. Traders say the volatility reflects uncertainty over fuel prices and trade flows: India’s refiners must suddenly scramble for alternate oil, while exporters fear a sudden loss of U.S. demand.

The Reserve Bank of India has intervened to support the rupee, but economists warn that if tensions drag on, inflation could creep higher and growth a bit lower.

Global Chessboard

On the broader stage, alliances are shifting. The U.S. is publicly courting India as a bulwark against China, but its unilateral tariffs risk alienating a key partner.

In India, foreign policy hawks see an opening: New Delhi quietly deepens ties with the Middle East and even discusses barter trade with Russia. Moscow, for its part, pushes harder on energy and arms ties, offering India even steeper oil discounts and fast‑tracking missile deals.

Europe also edges closer to India, frustrated by Trump’s unpredictability. In effect, the crisis is redrawing the global map: countries must now pick sides or find delicate new balances in a high‑stakes game of geopolitical chess.

What’s Next?

The fallout is still unfolding. In Congress, some lawmakers are eyeing even harsher penalties for Russia buyers; others fear hitting an essential partner. US diplomats will likely intensify behind-the-scenes talks with New Delhi in the coming weeks. India, for its part, will try to avoid an outright collision: analysts expect New Delhi to appeal for exemptions on certain supplies and seek new export markets in Asia and Africa.

But one thing is clear: this conflict over trade and oil has exposed fault lines in the post-Cold War order.

The world’s two most populous democracies now stand at a crossroads – and how they navigate this moment could reshape the course of international relations for years to come.