In a development that marks a historic first in U.S.-Russia relations, Moscow’s seizure of American business assets has reached an unprecedented milestone with the nationalization of Glavprodukt, the largest canned food producer in Russia.

This landmark case represents more than just another corporate casualty of geopolitical tensions—it signals a fundamental shift in how the Kremlin views foreign investment and American business interests.

The company, founded by Los Angeles-based entrepreneur Leonid Smirnov who fled Soviet communism in the 1970s, has become the first fully American-owned enterprise to be permanently transferred to Russian state control since the Ukraine invasion began. The seizure culminated in a six-hour Moscow Arbitration Court hearing that ended with complete government takeover of the $200 million enterprise.

Seizure Surge

Russia’s asset confiscation campaign has reached staggering proportions, with authorities seizing approximately $50 billion worth of private property since the Ukraine invasion began in February 2022. Moscow law firm Nektorov, Saveliev & Partners documented 102 cases of asset seizure from private owners, spanning strategic sectors vital to sustaining Russia’s war effort.

“The Kremlin is solving two problems at once,” explained Andrei Yakovlev, a Harvard University fellow specializing in Russian economics. “Reselling these nationalized businesses both brings in revenue and reshapes the business elite so their fate is tied to the regime’s survival.”

The surge in seizures accelerated dramatically in 2024, with the number of foreign businesses confiscated through presidential decrees rising from nine in 2023 to 16 this year.

American Exodus

U.S. companies have borne the heaviest losses among foreign investors, with American firms writing off an estimated $300 billion in Russian assets since the conflict began.

According to consulting firm Kept’s analysis, 59% of American companies with significant Russian operations have exited the market, though thousands of U.S.-owned subsidiaries continue operating under local management.

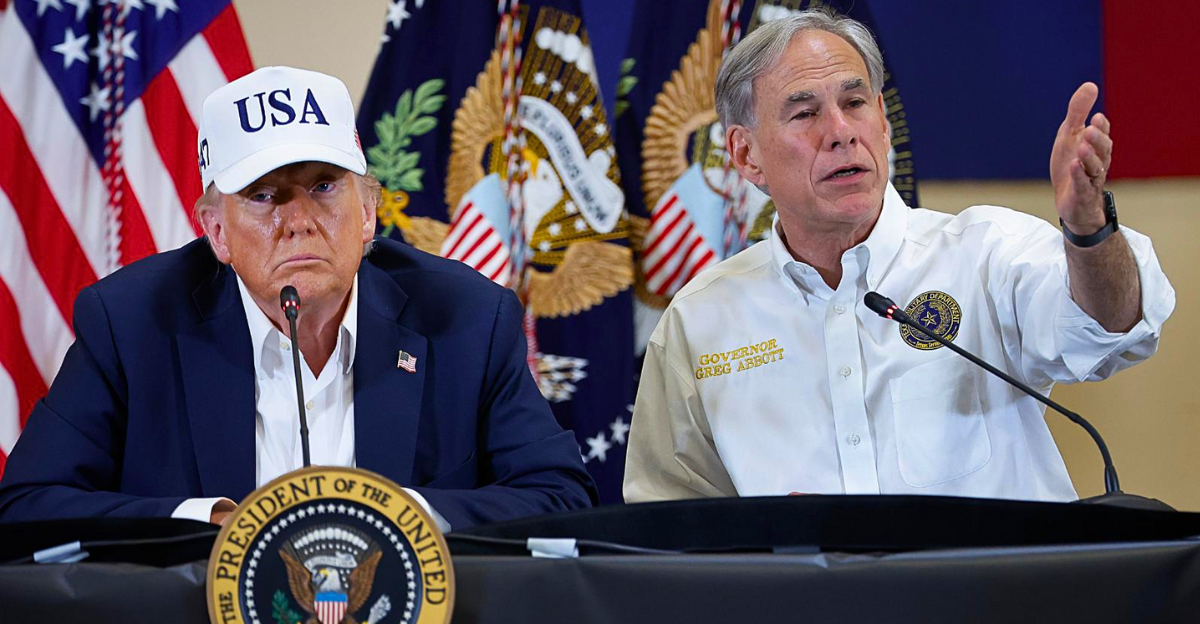

The exodus has created a diplomatic complication for Washington, as Secretary of State Marco Rubio acknowledged: “The issue of Glavprodukt would be part of any discussion about resetting U.S.-Russia relations.” The scale of American business exposure has made Russia’s nationalization campaign a significant factor in bilateral diplomatic calculations, with officials describing the seizures as “economic hostage-taking.”

Food Security

Russia’s food security concerns have intensified dramatically as the Ukraine conflict disrupts global supply chains, with wheat costs surging 23% above pre-war levels before stabilizing. The Kremlin has responded by tightening control over food-related enterprises, arguing that foreign ownership of agricultural assets poses national security risks during wartime.

An unnamed Russian official told state-controlled newspaper Kommersant that Rosimushchestvo would take over Glavprodukt to “ensure food security,” though the company’s performance has deteriorated markedly under state management.

Internal documents reveal that sales have plummeted by 30% since nationalization, forcing the company to seek new export markets in China and North Korea while struggling to maintain domestic production levels.

Court Verdict

On July 12, 2025, the Moscow Arbitration Court issued its final ruling that Glavprodukt be permanently transferred to Russian state control, ending months of legal battles over the company’s fate. The court satisfied prosecutors’ demands in full after a six-hour hearing, with immediate effect and no provision for appeal suspension.

“The court ruled that the general prosecutor’s case on the seizure of Glavprodukt assets and property of its head Smirnov in favor of the state be satisfied in full,” TASS quoted the court as saying. “The decision comes into force immediately.”

The ruling marked the completion of a process that began in October 2024 when the company was first placed under temporary state management, effectively ending Los Angeles-based founder Leonid Smirnov’s control over his estimated $200 million enterprise.

Corporate Assets

The seizure encompasses Glavprodukt’s entire industrial empire, including three major production facilities employing over 1,000 workers across strategic locations throughout Russia. The company commands significant market share with 10% of Russia’s stewed meat production, 7% of condensed milk, and 3% of tinned fish, making it a crucial component of the domestic food supply chain.

Court documents revealed that assets seized include not only the factories and inventory but also intellectual property rights, trademarks, and the company’s distribution network.

Since the state takeover, Russian federal property agency Rosimushchestvo has appointed new management, though internal documents show the company’s financial performance has deteriorated rapidly, sliding from modest profitability to regular monthly net losses.

Personal Testimony

“They claimed they took my company to secure food for Russia. But they are not living up to this purpose,” Leonid Smirnov told Reuters, his voice heavy with frustration over the destruction of his life’s work.

The 70-year-old entrepreneur, who emigrated from the Soviet Union in the 1970s and built Glavprodukt into Russia’s equivalent of Campbell’s Soup, now watches helplessly from his Beverly Hills mansion as his enterprise crumbles under state management.

“What is happening to my company is a raid under a government seizure and confiscation attempt,” Smirnov explained to the New York Post, calling the legal action a “Russian-style corporate raid” aimed at stealing his company. His desperate appeals to President Trump for intervention highlight the human cost of geopolitical tensions, as individual entrepreneurs become pawns in larger diplomatic games.

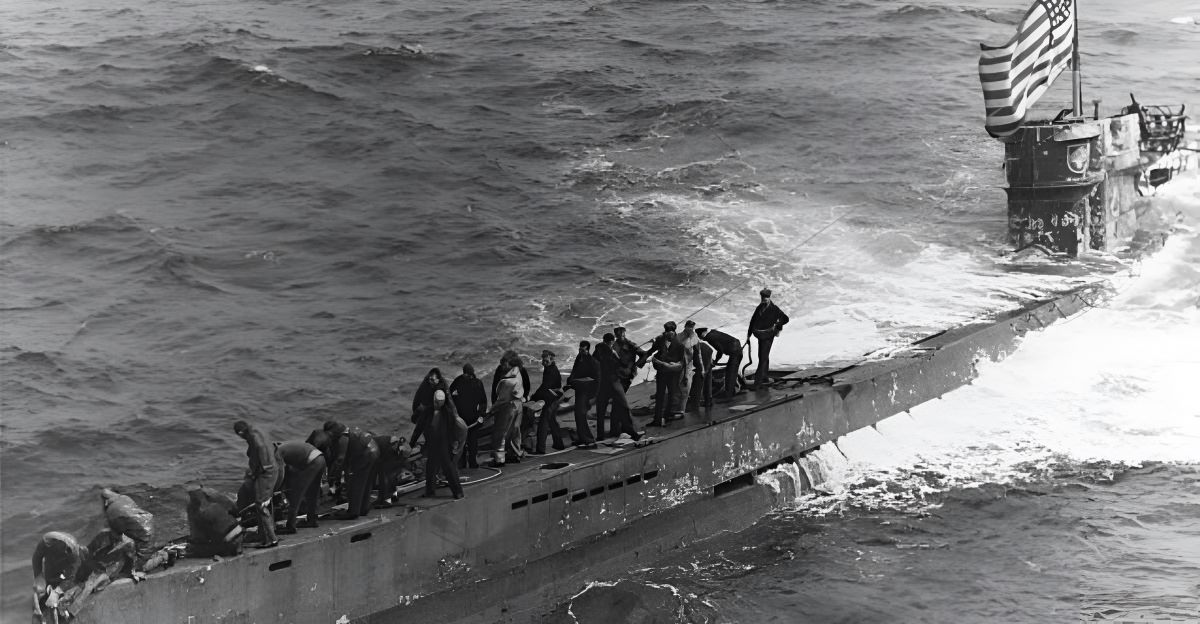

Military Connection

Disturbing internal documents obtained by Reuters reveal that Glavprodukt’s new state management plans to redirect the company’s output to Russia’s military forces and National Guard.

The seizure has effectively placed the company under the control of Druzhba Narodov, a food supplier with deep ties to former Agriculture Minister Alexander Tkachev, who was sanctioned by the EU for supporting Crimea’s annexation.

“The seizure was necessary to ensure stable production, including for future supplies to the national guard and defence ministry,” according to a letter from Glavprodukt’s new management to Russia’s prosecutor general.

This military connection transforms Glavprodukt from a civilian food producer into a component of Russia’s war machine, raising the stakes for any future diplomatic resolution between Washington and Moscow.

Diplomatic Stakes

The Glavprodukt case has become a significant factor in U.S.-Russia negotiations, with Secretary of State Marco Rubio explicitly stating that the company’s treatment will influence broader diplomatic relations. “We’re going to continue to stay involved where we see opportunities to make a difference,” Rubio told reporters after meeting with Russian Foreign Minister Sergey Lavrov in Malaysia.

During recent talks, Rubio expressed that President Trump has been “disappointed and frustrated that there’s not been more flexibility on the Russian side” to bring about an end to the conflict.

The timing of the final court ruling, coming just days after Trump expressed disappointment with Putin’s negotiating position, suggests Moscow may be using seized assets as bargaining chips in broader diplomatic negotiations.

Economic Crossroads

As Trump’s reset ambitions collide with Putin’s maximalist demands, Russia’s economy shows signs of strain that could influence the fate of seized American assets. The country’s GDP growth has slowed dramatically to just 1.4% in the first quarter of 2025, down from 4.5% in the previous quarter, representing the slowest pace since the economy resumed expansion in 2023.

“Russia’s wartime growth engine is losing steam,” according to analysis by the NEST Centre, with defense-related industries operating near full capacity while civilian sectors remain constrained by high interest rates.

The World Bank forecasts continued economic deceleration, predicting just 1.4% growth for 2025 and 1.2% for 2026, creating pressure for Moscow to balance its need for foreign investment against strategic control over key industries.