A recent Russian action has seriously damaged a key U.S. strategy to secure vital minerals needed for energy and national security. While details are still unfolding, this loss could disrupt America’s supply of materials crucial for electric vehicles, batteries, and defense technology.

The impact reaches far beyond the battlefield, touching industries that rely on steady mineral supplies. This development raises urgent questions about how the U.S. will protect its future access to critical resources.

America’s Plan to Cut China Out

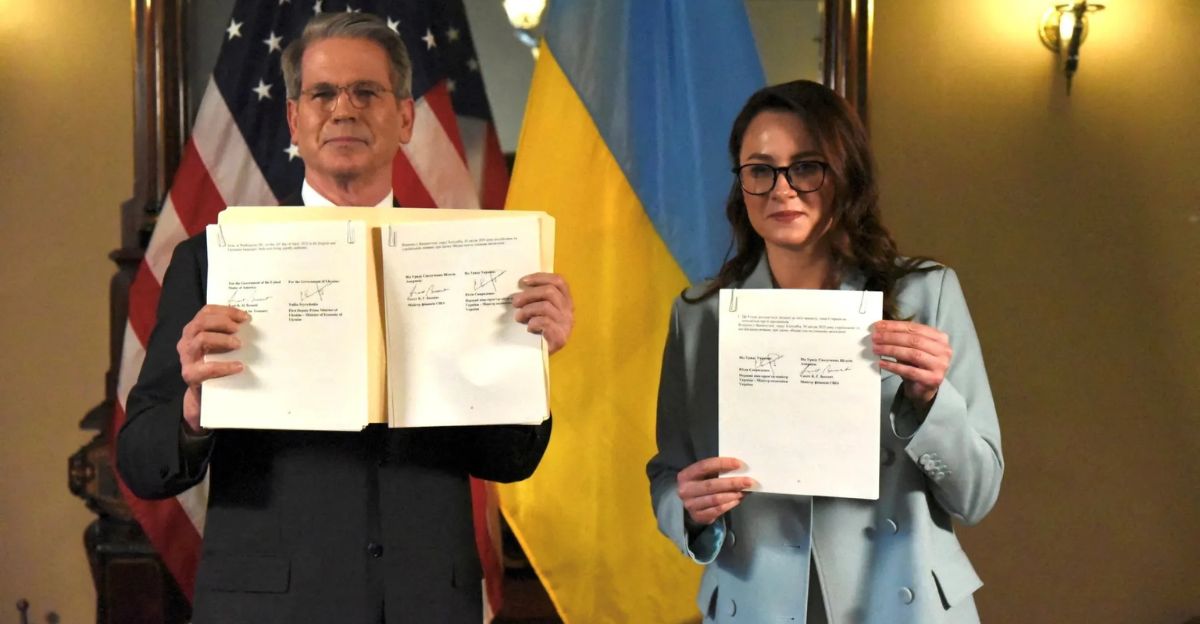

The U.S. worked hard to reduce its heavy dependence on China for lithium, a mineral vital for tech and defense. In April, the U.S. and Ukraine signed a deal to give America first access to Ukraine’s lithium reserves through a shared investment fund.

This was meant to be a smart way to support Ukraine and secure minerals without traditional military aid. Ukraine holds nearly 10% of the world’s lithium, one of Europe’s largest reserves. But the war has shown how risky relying on resources in conflict zones can be.

Russia Takes Over a Key Lithium Site

According to The New York Times, Russian forces captured the village of Shevchenko and its lithium deposit in eastern Ukraine on June 27-28. This site covers about 40 hectares and contains between 11 and 14 million tons of high-quality lithium ore. It has a lithium content above 1.5% and mostly spodumene, making mining profitable. The deposit is worth around $141 billion, one of Europe’s biggest.

Mykhailo Zhernov, director of the American company that once had rights there, warned, “If Russian troops advance further and seize additional territory, they will gain control over more mineral deposits.” This shows how military advances affect control of resources.

Why Shevchenko Is So Important to the U.S.

Shevchenko is a vital part of America’s supply chain for batteries and defense technology. Lithium powers everything from smartphones to military equipment, and the Pentagon sees it as essential for security. The Defense Department has invested in better lithium batteries to make gear lighter and last longer. This site’s spodumene-rich ore is easier and cheaper to process than other types.

With global lithium demand rising fast and U.S. battery production growing, losing this source means more pressure on other suppliers or more expensive local options. The stakes are very high.

The Global Lithium Race Is Already Tight

Before this loss, lithium supplies were already under strain. China is expected to become the top lithium producer by 2026, beating Australia by thousands of tons yearly. China keeps expanding its mining even when it isn’t immediately profitable, while some Western companies cut back.

The U.S. battery industry is growing fast but still needs steady lithium supplies. Paul Lusty from Fastmarkets points out China’s clear plan to develop its mineral resources. Losing Shevchenko adds stress to a market where demand is growing faster than supply. The competition for lithium is only getting fiercer.

The Deal Still Stands, Even After Losing Shevchenko

Despite Russia’s capture of the Shevchenko site, the U.S.-Ukraine minerals deal is staying in place. Serhii Fursa, deputy managing director at Dragon Capital, said the loss won’t derail the agreement because Shevchenko was always seen as high-risk. “Nobody assumed it would be a good asset for any kind of deal,” he said.

The partnership was built with the idea that some sites might be lost in the war. Fortunately, Ukraine still controls two key lithium fields in safer regions. That’s where the deal now shifts its focus.

Let’s look at what the agreement actually promised—or didn’t.

U.S. Was Never Promised Specific Lithium Sites

The U.S. minerals deal doesn’t lock in access to any specific mine. According to the agreement, Ukraine has full control over which areas it allows for exploration and development. The text clearly says Ukraine “retains the right to determine the areas” made available.

There were no security guarantees, and while Ukraine pushed for them during talks, they weren’t included. The deal reflects strategic alignment and long-term cooperation, not fixed promises. So while Shevchenko is a loss, it doesn’t break the agreement or its terms.

First Project Under the Deal Already Underway

Progress hasn’t stopped. In June 2025, Ukraine approved early steps to open the Dobra lithium deposit to private investors. This central Ukrainian site holds 80 to 105 million metric tons of lithium ore, much larger than Shevchenko. It’s now set to become the first active project under the U.S. minerals deal.

Officials from both countries plan to launch the investment fund by the end of 2025. The fund’s first board meeting is scheduled for July. First Deputy Prime Minister Yulia Svyrydenko said they’ll soon discuss the seed capital needed to begin.

Still, risks remain if the front line keeps shifting.

Investor Nerves Are Rising as Russia Advances

While the deal moves ahead, not everyone feels confident. Analysts warn that Russia’s steady progress is rattling investors. If Moscow captures more territory, especially in resource-rich areas, the pressure could grow.

The loss of Shevchenko fits into a broader strategy: control the minerals, control the future. Ukraine’s mineral corridors remain a tempting target. Investors are now watching closely to see whether the central lithium sites stay safe. For now, those fields remain secure, but that could change.

So what does the U.S. government say about the shifting risks?

U.S. Still Committed, but Playing It Cool

The Trump administration hasn’t changed course. Secretary of State Marco Rubio confirmed that the U.S. still backs the minerals deal. While Trump has avoided pushing for harsher sanctions, Rubio said, “We’re going to continue to engage” in diplomacy. The approach remains transactional, focused on long-term gains rather than short-term retaliation.

America is watching the battlefield closely, but it hasn’t walked away from the economic opportunity this partnership offers. The minerals deal may be evolving, but for now, both sides are staying the course.

So where does this leave the balance of power over global lithium?